Resilient Growth of Chinese-Made Best Electronic MCCBs Amidst US-China Tariff Strife: An Industry Analysis

In an era marked by escalating trade tensions and tariffs between the United States and China, the electronic MCCB (Molded Case Circuit Breaker) sector presents a compelling narrative of resilience and growth. According to a recent report from Market Research Future, the global market for electronic MCCBs is projected to reach $5.3 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2023. Despite the challenges posed by tariffs that have affected numerous industries, Chinese manufacturers have adeptly navigated these hurdles, leading to a notable increase in both production and export volumes of electronic MCCBs. As the demand for reliable and efficient electrical protection devices continues to rise, particularly in fast-developing sectors such as renewable energy and industrial automation, Chinese-made electronic MCCBs are not only thriving but are also setting new standards for innovation and quality in the global market.

Impact of US-China Tariff Policies on the Electronic MCCB Market

The ongoing trade tensions between the US and China have introduced significant volatility into the electronic MCCB (Molded Case Circuit Breaker) market. US tariffs on Chinese imports have prompted manufacturers to reassess their supply chains and pricing strategies. While these policies aim to protect domestic industries, they inadvertently push Chinese companies to innovate and improve their product offerings, making them more competitive not just in China, but on a global scale.

As tariffs raise costs for American companies reliant on imported components, many are now seeking alternatives. This shift has led to an increased demand for locally produced MCCBs or sourcing from countries not subject to tariffs. Consequently, Chinese manufacturers have capitalized on this opportunity by enhancing production efficiencies and focusing on advanced technology in their product lines. The resilience demonstrated by these companies under pressure speaks volumes about their potential to capture market share and foster growth despite the turbulent geopolitical landscape.

Impact of US-China Tariff Policies on Electronic MCCB Market

This chart illustrates the growth in sales of Chinese-made electronic MCCBs (Miniature Circuit Breakers) amid fluctuating US-China tariff policies from 2018 to 2023.

Strategies Employed by Chinese Manufacturers to Navigate Tariff Challenges

Amidst the tumultuous backdrop of escalating US-China tariffs, Chinese manufacturers are adopting innovative strategies to navigate these challenges, particularly in industries like electronic MCCBs. With the recent announcement of substantial tariffs on Chinese products, companies are now compelled to rethink their supply chain operations and market strategies to maintain competitiveness. Many firms are shifting production to countries with lower tariff implications, leveraging Southeast Asia's manufacturing capabilities as an alternative to mitigate the financial burden imposed by these tariffs.

In addition to geographical shifts, Chinese manufacturers are focusing on enhancing product quality and innovation. Reports indicate a marked improvement in the quality of patents filed by Chinese electric vehicle and battery manufacturers, surpassing their American and Japanese counterparts. This trend reflects a broader commitment to not only meet domestic demands but also to position themselves favorably in international markets. By prioritizing innovation and quality improvement, these manufacturers are not simply responding to tariffs but are actively seeking growth opportunities and reinforcing their resilience in a complex global landscape.

Resilient Growth of Chinese-Made Best Electronic MCCBs Amidst US-China Tariff Strife: An Industry Analysis

| Manufacturer | Annual Revenue (in Million USD) | Market Share (%) | Main Export Markets | Strategies to Navigate Tariffs |

|---|---|---|---|---|

| Company A | 500 | 15 | USA, Europe, Southeast Asia | Promoting local manufacturing partnerships |

| Company B | 350 | 10 | Americas, Australia | Investing in supply chain diversification |

| Company C | 600 | 20 | UK, Asia | Enhancing product innovation |

| Company D | 450 | 12 | Middle East, North Africa | Local assembly to minimize tariffs |

Growth Trends of Chinese-Made MCCBs Amidst Global Trade Tensions

The global trade tensions have significantly impacted various industries, including the electrical equipment sector, where Chinese-made Molded Case Circuit Breakers (MCCBs) have exhibited remarkable resilience. According to a report by MarketsandMarkets, the global MCCB market size was valued at approximately $6.0 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of around 5.2% from 2022 to 2030. This growth trajectory illustrates how Chinese manufacturers are adapting to the evolving trade landscape and exploring new markets.

Chinese manufacturers have strategically leveraged their advanced manufacturing capabilities to enhance product quality and reduce costs, allowing them to maintain competitive pricing even amidst US-China tariff tensions. Data from Statista indicates that China's share in the global MCCB market has grown from 25% in 2018 to over 35% in 2022. This increase can be attributed to their commitment to innovation and the development of more energy-efficient solutions, responding to the rising demand for sustainable electrical equipment worldwide. With their robust supply chains and expansive production networks, Chinese MCCB producers are not just surviving but thriving in a challenging global environment.

Competitive Advantages of Chinese MCCBs in the Global Marketplace

The global marketplace is witnessing an upsurge in demand for electronic molded case circuit breakers (MCCBs), with Chinese manufacturers positioning themselves advantageously despite ongoing US-China tariff tensions. One of the primary competitive advantages of Chinese MCCBs is their ability to provide cost-effective solutions without compromising quality. By leveraging advanced manufacturing techniques and economies of scale, Chinese companies can offer products at competitive prices, making them appealing to international buyers seeking value.

In addition to cost-effectiveness, Chinese MCCBs benefit from robust supply chains and rapid innovation cycles. Manufacturers have focused on enhancing product features, such as improved energy efficiency and smarter technologies that align with modern electrification trends. This commitment to innovation ensures that Chinese MCCBs not only meet but often exceed international standards, allowing them to capture significant market share even in regions traditionally dominated by Western competitors. As sustainability becomes a more pressing concern for industries worldwide, the ability of Chinese manufacturers to adapt and innovate positions them favorably in the rapidly evolving global landscape.

Global Market Share of MCCB Manufacturers (2023)

Future Outlook for the Electronic MCCB Industry in Light of Trade Dynamics

The electronic MCCB industry is poised for notable evolution amid the shifting landscapes of international trade dynamics. As the US-China tariff tensions persist, the resilience of Chinese-made electronic MCCBs stands out. Despite economic headwinds faced in 2024, reports indicate that the electronics sector is gearing up for significant growth in 2025, driven by consumer demand for premium and feature-rich products. This growth is not isolated; it echoes a broader trend in the electronics industry, where a shift towards advanced technologies and diversified supply chains in regions such as Southeast Asia is gaining momentum.

Moreover, as global trade flows undergo dramatic changes, China’s electronic manufacturing sector remains a critical player, leveraging its capabilities to cater to evolving market demands. The anticipated recovery and expansion from 2025 to 2027 indicate a promising outlook for integrated circuits, which are essential components within the MCCB landscape. By adapting to new technologies and consumer preferences, the electronic MCCB industry is not only resilient but also strategically positioned to capitalize on emerging opportunities in an increasingly interconnected and competitive global market.

JCB1-125

JCB1-125 JCB2-40M

JCB2-40M JCB3-63DC

JCB3-63DC JCB3-80H

JCB3-80H JCB3-80M

JCB3-80M JCBH-125

JCBH-125 JC125-4P

JC125-4P JCMX

JCMX JCSD

JCSD JCOF

JCOF JCMX1-125

JCMX1-125 JCOF1-125

JCOF1-125 JCSD1-125

JCSD1-125 JCR3HM

JCR3HM JCRD2-125

JCRD2-125 JCRD4-125

JCRD4-125 JCRB2-100

JCRB2-100 JC3RH-2P

JC3RH-2P JC3RH-S

JC3RH-S JC3RH-B

JC3RH-B JC3RH-BS

JC3RH-BS JCR2-63

JCR2-63 JCR1-40

JCR1-40 JCB2LE-80M

JCB2LE-80M JCB2LE-80M

JCB2LE-80M JCB2LE-80M

JCB2LE-80M JCB2LE-40M

JCB2LE-40M JCB1LE-125

JCB1LE-125 JCB3LM-80

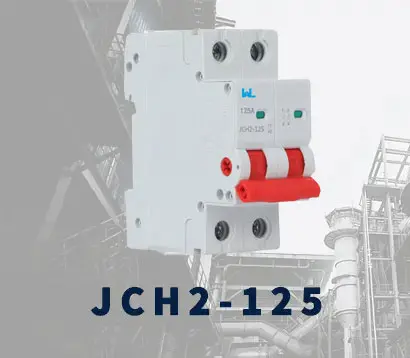

JCB3LM-80 JCH2-125

JCH2-125 JCH2-125

JCH2-125 CJX2

CJX2 CJ19

CJ19 JCMCU

JCMCU JCHA

JCHA JCSD-40

JCSD-40 JCSD-60

JCSD-60 JCSP-40

JCSP-40 JCSP-60

JCSP-60 JCSPV

JCSPV WEW1-1000

WEW1-1000 WEW1-1600

WEW1-1600 WEW1-2000

WEW1-2000 WEW1-3200

WEW1-3200 WEW1-4000

WEW1-4000 WEW1-6300

WEW1-6300 DC6-125

DC6-125 AX-400-1250

AX-400-1250 AXAL-400-1250A

AXAL-400-1250A AL-400-1250

AL-400-1250 DC3-160

DC3-160 AXS-400-1250A

AXS-400-1250A SHT-125-160

SHT-125-160 UVT-125-160A

UVT-125-160A P-250A-3P-A

P-250A-3P-A 400-3P/4P terminal cover

400-3P/4P terminal cover 1250-3Pmccb accessories busbar

1250-3Pmccb accessories busbar 250-3P terminal conver

250-3P terminal conver WLM6-TCV-160A-3P

WLM6-TCV-160A-3P WLM6-MIP-250A

WLM6-MIP-250A WLM6-125A-3300 3P/4P

WLM6-125A-3300 3P/4P WLM6-160A-3300 3P/4P

WLM6-160A-3300 3P/4P WLM6-250A-3300 3P/4P

WLM6-250A-3300 3P/4P WLM6-400A-3300 3P/4P

WLM6-400A-3300 3P/4P WLM6-630A-3300 3P/4P

WLM6-630A-3300 3P/4P WLM6-800A-3300 3P/4P

WLM6-800A-3300 3P/4P WLM6-1250A-3300 3P/4P

WLM6-1250A-3300 3P/4P WLM6-1600A-3300 3P/4P

WLM6-1600A-3300 3P/4P WLM6-2000A 3P/4P

WLM6-2000A 3P/4P WLM8-125H-3300

WLM8-125H-3300 WLM8-250H-3300

WLM8-250H-3300 WLM8-400H-3300

WLM8-400H-3300 WLM8-400H-4300

WLM8-400H-4300 WLM8-630H-3300

WLM8-630H-3300 WLM8-630H-4300

WLM8-630H-4300 WLM6RT-125A

WLM6RT-125A WLM6RT-160A

WLM6RT-160A WLM6RT-250A

WLM6RT-250A WLM6RT-400A

WLM6RT-400A WLM6RT-630A

WLM6RT-630A WLM6RT-800A

WLM6RT-800A WLM6RT-1250A

WLM6RT-1250A WLM6E-160A-3300 3P

WLM6E-160A-3300 3P WLM6E-250A-3300

WLM6E-250A-3300 WLM6E-400A-3300 3P/4P

WLM6E-400A-3300 3P/4P WLM6E-630A-3300

WLM6E-630A-3300 WLM6E-800A-3300 3P/4P

WLM6E-800A-3300 3P/4P WLM6E-1250A-3300

WLM6E-1250A-3300 WLM6E-1600-3300 3P/4P

WLM6E-1600-3300 3P/4P WLM6E-2000A-3300 3P/4P

WLM6E-2000A-3300 3P/4P WLM8E-250H-3300

WLM8E-250H-3300 WLM8E-400H-3300

WLM8E-400H-3300 WLM8E-400H-4300

WLM8E-400H-4300 WLM8E-630H-3300

WLM8E-630H-3300 WLM8E-630H-4300

WLM8E-630H-4300 WLM6EY-250-3300 3P/4P

WLM6EY-250-3300 3P/4P WLM6EY-400 3P/4P

WLM6EY-400 3P/4P WLM6EY-630 3P/4P

WLM6EY-630 3P/4P WLM6EY-800A 3P/4P

WLM6EY-800A 3P/4P WLM6EY-1250A 3P/4P

WLM6EY-1250A 3P/4P WLM6ELY-160A

WLM6ELY-160A WLM6ELY-250A

WLM6ELY-250A WLM6ELY-400A

WLM6ELY-400A WLM6ELY-800A

WLM6ELY-800A WLM6ELY-1250A

WLM6ELY-1250A WLM8EY-250H-3300

WLM8EY-250H-3300 WLM8EY-400H-3300

WLM8EY-400H-3300 WLM8EY-630H-3300

WLM8EY-630H-3300 WLM6LY-125A

WLM6LY-125A WLM6L-160A

WLM6L-160A WLM6LY-250A

WLM6LY-250A WLM6LY-400A

WLM6LY-400A WLM6LY-800A

WLM6LY-800A WLM6LY-630A

WLM6LY-630A WLM6LY-1250A

WLM6LY-1250A WLM8LY-125H-3300

WLM8LY-125H-3300 WLM8LY-250H-3300

WLM8LY-250H-3300 WLM8LY-400H-3300

WLM8LY-400H-3300 WLM8LY-630H-3300

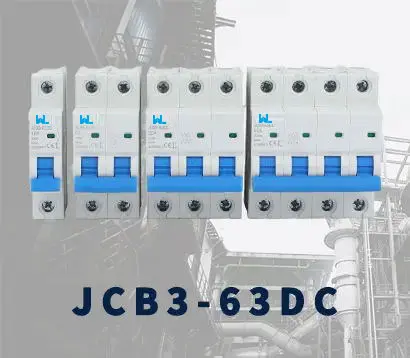

WLM8LY-630H-3300 JCB3-63DC

JCB3-63DC JCB1-125DC

JCB1-125DC WLM7DC-250A-2300 2P/3P

WLM7DC-250A-2300 2P/3P WLM7DC-315A-3300 2P/3P

WLM7DC-315A-3300 2P/3P WLM7DC-400A-2300 2P/3P

WLM7DC-400A-2300 2P/3P WLM7DC-630A-3300 3P

WLM7DC-630A-3300 3P WLM7DC-800A-2300 2P/3P

WLM7DC-800A-2300 2P/3P WLM7DC-400A 2300

WLM7DC-400A 2300 WLM7DC-630A-2300 2P

WLM7DC-630A-2300 2P WLM7HU-250-3300 3P

WLM7HU-250-3300 3P WLM7HU-315-3300 3P

WLM7HU-315-3300 3P WLM7HU-400-3300 3P

WLM7HU-400-3300 3P WLM7HU-630-3300 3P

WLM7HU-630-3300 3P WLM7HU-800-3300 3P

WLM7HU-800-3300 3P PV-1500V/250A

PV-1500V/250A WEW3-1600

WEW3-1600 WEW3-2500

WEW3-2500 WEW3-4000

WEW3-4000 WEW3-7500

WEW3-7500